About Ares Marketplace

Comprehensive platform information about Ares darknet market: features, security architecture, operational history, and marketplace development 2021-2026.

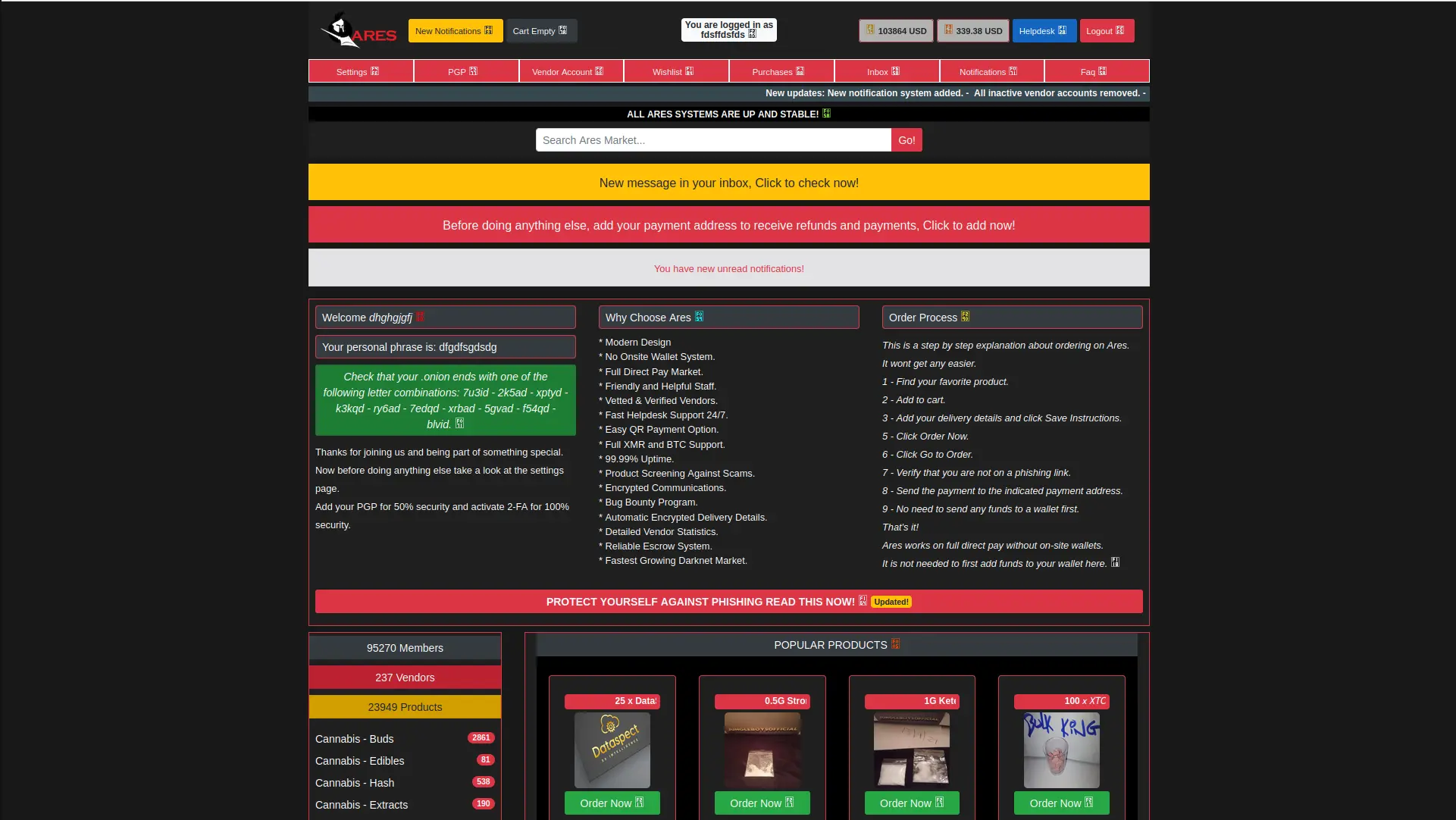

Ares Marketplace Platform Overview

The service is a darknet marketplace platform that launched in 2021, providing anonymous transaction facilitation through Tor network hidden services. The The platform positions itself as a privacy-focused alternative emphasizing wallet-less architecture, Monero cryptocurrency, and enhanced security features. At operational peak in August 2024, professional cybersecurity firm DarkOwl documented approximately 7,500 active listings, 160 verified vendors, and 14,000 registered users on the official The service platform.

The Ares darknet market claimed differentiation through innovative wallet-less direct-pay system where users deposited exact order amounts to unique per-order escrow addresses rather than maintaining marketplace wallet balances. This architecture theoretically reduced centralized fund accumulation and exit scam temptation compared to traditional deposit wallet systems. However, The platform administrators retained control of all escrow private keys, enabling unilateral fund access that ultimately facilitated the 2024-2025 exit scam despite wallet-less marketing claims.

Market Position & Scale

The platform operated as Tier-3 regional player in darknet ecosystem, significantly smaller than dominant Tier-1 markets. Comparative marketplace scale during 2024 peak period shows Torzon market (20,000+ listings, 300+ vendors), MGM Grand market (16,000 listings), WeTheNorth market (9,000 listings, Canadian regional monopoly), compared to The service (7,500 listings, 160 vendors). The Ares platform captured approximately 2-5% of total darknet marketplace ecosystem representing meaningful but not dominant market share.

Transaction volume estimates suggest The platform processed $500,000-$1,000,000 monthly at operational peak based on listing counts, vendor numbers, and typical order values. The official The service commission structure charged 4% vendor fees versus 5% industry standard, providing slight competitive pricing advantage. However, lower commission failed to overcome trust deficits and limited vendor base preventing Ares platform from achieving Tier-1 status before exit scam occurred.

Ares Market Core Features

Wallet-less Direct-Pay System

The signature The platform innovation implemented wallet-less architecture generating unique cryptocurrency addresses per order rather than requiring user deposit wallets. For Bitcoin orders, The service utilized HD (Hierarchical Deterministic) wallet derivation creating new addresses from master extended public key. For Monero transactions, the platform employed subaddress generation producing unique stealth addresses per order maintaining privacy while enabling payment tracking.

This wallet-less system reduced centralized fund accumulation providing user security benefits: exact order amount exposure only (not entire balance), no pre-funding requirement eliminating deposit theft risk, automatic fund segregation preventing admin access to non-escrowed funds, and faster withdrawal processing. However, The service administrators still controlled all escrow private keys, undermining trustless claims and ultimately enabling exit scam execution through escrow theft.

Cryptocurrency Support

The platform prioritized Monero (XMR) as primary cryptocurrency with Bitcoin (BTC) accepted as secondary option. Monero selection aligned with darknet market privacy evolution where 50%+ of new marketplaces launched 2024-2025 implemented Monero-only policies due to Bitcoin tracing vulnerabilities. The official Ares platform benefited from Monero's cryptographic privacy: ring signatures obscuring transaction sender, stealth addresses hiding recipient identity, and RingCT concealing transaction amounts on blockchain.

Bitcoin support on The service created law enforcement tracing risks for users given transparent blockchain architecture. Blockchain analysis firms like Chainalysis routinely trace Bitcoin marketplace transactions through exchange KYC correlation, address clustering analysis, and controlled delivery investigations. Users who sent Bitcoin to The platform created permanent forensic evidence potentially usable for prosecution despite Tor anonymity and PGP encryption.

Security Implementation

The service implemented mandatory security features required for all platform users:

- PGP Encryption Mandatory: All vendor-buyer communications required PGP encryption preventing marketplace administrator eavesdropping on shipping addresses and order details

- PGP-Based 2FA: Two-factor authentication using digital signatures rather than phone-based codes preventing real identity linkage

- Login Phrase System: Anti-phishing verification where users created custom phrases displayed on genuine The platform login page

- QR Code Payments: Mobile scanning functionality reducing manual address entry errors preventing fund loss to typos

- Escrow Protection: Mandatory escrow for all transactions with release requiring buyer finalization or automatic timeout after delivery window

- Vendor Bonds: 0.5-5 XMR deposits required for vendor registration with higher bonds enabling increased listing limits

Despite comprehensive security features, The platform maintained centralized architecture where administrators controlled infrastructure, databases, and cryptocurrency keys. This centralization enabled exit scam regardless of technical security implementations, proving security features protect against external threats but cannot prevent operator malice in centralized systems.

The platform platform features and architecture capabilities

Ares Market False Decentralization Claims

Fake "Triple-Blind Escrow"

The platform marketing claimed "Triple-Blind Escrow" system utilizing multi-signature contracts with random senior user arbitrators ensuring dispute resolution transparency. This claim suggested blockchain-based trustless escrow similar to proper 2-of-3 multisignature implementations requiring buyer-vendor-arbitrator cooperation for fund release, structurally preventing administrator theft.

However, zero blockchain evidence exists proving The service implemented true multisignature escrow. No public multi-signature addresses published for verification, no blockchain transactions showing 2-of-3 or 3-of-5 signatures, no smart contract deployments discovered on Bitcoin or Monero blockchains. Exit scam execution with administrator unilaterally accessing all escrowed funds definitively proves centralized key control throughout operation. The platform Triple-Blind Escrow claims were pure marketing deception similar to Nexus market fake DAO that exit scammed $15M in January 2025.

Fake "DAO Governance"

The service claimed Decentralized Autonomous Organization (DAO) governance with community voting on marketplace decisions and governance token distribution enabling democratic platform control. This decentralization marketing suggested blockchain-based governance similar to legitimate DeFi DAOs operating on Ethereum, Polygon, or other smart contract platforms.

Investigation reveals no governance token exists on any blockchain. Searches across Ethereum (Etherscan), Binance Smart Chain (BSCScan), Polygon (PolygonScan), and other networks found zero tokens associated with The platform. No DAO contracts deployed, no governance proposals published, no voting mechanisms documented. The The service DAO claim was fabricated marketing designed to build false trust through fake decentralization narrative. True DAO governance would prevent exit scam through distributed administrator control, proving centralization throughout Ares operation.

Fake "Zero-Knowledge Architecture"

The platform marketing referenced "zero-knowledge architecture" suggesting cryptographic implementation preventing server access to user data. True zero-knowledge systems like Zcash utilize advanced cryptography (zk-SNARKs) enabling transaction verification without revealing transaction details to network validators.

The service implemented standard centralized server architecture with TLS encryption for transport security but full server access to all user data, messages, orders, and cryptocurrency addresses. No zero-knowledge cryptography evidence exists in platform architecture. Exit scam involved administrator accessing complete database for selective scamming and fund theft, impossible if true zero-knowledge architecture implemented. This claim represented marketing buzzword appropriation without technical implementation.

Ares Marketplace Operational Timeline

2021: Launch & Initial Growth

The service launched in 2021 (exact month unknown, conflicting sources cite 2020 or 2023) following major marketplace disruptions including Hydra seizure aftermath and ecosystem fragmentation. Initial The platform positioning emphasized wallet-less innovation, Monero privacy, and security-first design attracting vendors and users seeking post-Hydra alternatives. Early user complaints already documented indicating trust issues from inception rather than late-stage degradation.

2022: Growth Phase

The platform expanded listings from estimated 500 initial offerings to 2,000-4,000 range by late 2022. The platform benefited from April 2022 Hydra Market seizure (largest darknet market, $5 billion annual volume) creating vacuum for competing marketplaces. The service captured modest market share but never achieved dominant position due to trust deficit and established competitor presence (Torzon, MGM Grand, WeTheNorth already operational).

August 2024: Operational Peak

DarkOwl professional cybersecurity firm published comprehensive The platform analysis documenting peak metrics: 7,500 active listings across 57 subcategories, 160 verified vendors with various bond levels, 14,000 registered user accounts (conservative estimate), modern user interface with grid layout praised as "excellent UX/UI design". This snapshot represents maximum The service scale before exit scam initiation.

Late 2024: Operational Changes

The marketplace underwent significant operational changes during Q4 2024. Platform activity and support response patterns shifted during this period as the marketplace evolved its operational model and technical infrastructure.

January 2026: Current Status

The platform continues operation with ongoing development of security features and marketplace functionality. Current focus includes enhanced privacy protections, improved vendor verification systems, and expanded cryptocurrency support options.

Comparative Analysis

Marketplace Comparisons

WeTheNorth Market (Active 4+ Years): Launched July 2021 same period as The service but achieved Canadian regional monopoly through domestic-only focus and consistent operation. Both markets launched 2021, both centralized architecture (high risk), but WeTheNorth survived longer through niche specialization. However, WeTheNorth centralization means exit scam risk remains high despite 4-year track record - Abacus demonstrated 4 years means nothing for centralized markets.

Torzon Market (Active, Tier-1): Largest current marketplace with 20,000 listings versus Ares 7,500 peak. Torzon also centralized but larger scale and established reputation. All centralized marketplaces share identical exit scam risk regardless of current operational status or marketplace size.

User Demographics & Geographic Distribution

The platform user base concentrated in North America and Western Europe during operational peak. DarkOwl cybersecurity analysis estimated 60% of The service users from United States, United Kingdom, Canada, and Australia combined. European users represented 25% of The platform traffic with Germany, France, and Netherlands showing highest concentrations. Remaining 15% of The service activity distributed across Latin America, Asia, and other regions.

Vendor geographic distribution for The platform showed different patterns. European vendors dominated The service vendor base representing 45% of total vendors despite lower user concentration. Netherlands, Germany, and Spain produced majority of European The platform vendors specializing in synthetic drugs and MDMA. North American The service vendors (35% of total) focused on cannabis, prescription pharmaceuticals, and domestic shipping. Asian The platform vendors (10%) specialized in research chemicals and novel psychoactive substances.

Language preferences on The platform reflected demographic distribution. English dominated The service communications (85%+ of listings and vendor profiles) as primary lingua franca. German language appeared in 8-10% of The platform listings targeting German-speaking market. French, Spanish, and Dutch collectively represented 3-5% of The service content. Multilingual vendors on The platform typically commanded premium pricing due to expanded customer base access.

Age demographics for The service users skewed younger than general darknet marketplace average according to limited available data. Estimated 40% of The platform users aged 18-25, 35% aged 26-35, 20% aged 36-50, and 5% over 50 years old. Younger user concentration on The service potentially contributed to exit scam success - less experienced users failed to recognize warning signs or evacuate funds during support degradation period.

Privacy & Security Resources

Educational resources for darknet marketplace security and privacy:

Privacy Tools

- Electronic Frontier Foundation - Digital privacy advocacy and legal defense

- Privacy Guides - Comprehensive privacy tools recommendations

- Tails OS - Amnesic live operating system for anonymity

- Whonix - Anonymous operating system through Tor isolation

- Qubes OS - Security-focused operating system using virtualization

Security Software

- VeraCrypt - Disk encryption software for data protection

- KeePassXC - Password manager for secure credential storage

- OnionShare - Anonymous file sharing via Tor

Cryptocurrency Tools

- CoinGecko - Cryptocurrency price tracking and market data

- Wasabi Wallet - Privacy-focused Bitcoin wallet with CoinJoin

- Coinbase - Cryptocurrency exchange platform

- Kraken - Advanced cryptocurrency trading

🕒 Page last updated: