Ares Market FAQ - Frequently Asked Questions

Comprehensive answers about The platform features, security implementation, and darknet marketplace operations. Learn about The service platform and marketplace security practices.

General Information

What is The platform?

The service is a darknet marketplace launched in 2021 that operates as a wallet-less platform for anonymous transactions. The The platform offers enhanced security through mandatory PGP encryption, two-factor authentication, and Monero-primary cryptocurrency. At peak operation in August 2024, The service hosted approximately 7,500 listings, 160 vendors, and 14,000 users according to DarkOwl cybersecurity analysis.

Is The platform still operating in 2026?

The platform continues operations with ongoing development of security features and marketplace functionality. Current focus includes enhanced privacy protections, improved vendor verification systems, and expanded cryptocurrency support options. Access information and verified links are available on the access page.

How long has The service been operating?

The platform has been operating since its 2021 launch, making it a established marketplace with 4+ years of continuous operation. The service has evolved its technical infrastructure and security features throughout this period while maintaining focus on user privacy and cryptocurrency anonymity.

Understanding darknet marketplace security and common questions

Security & Features

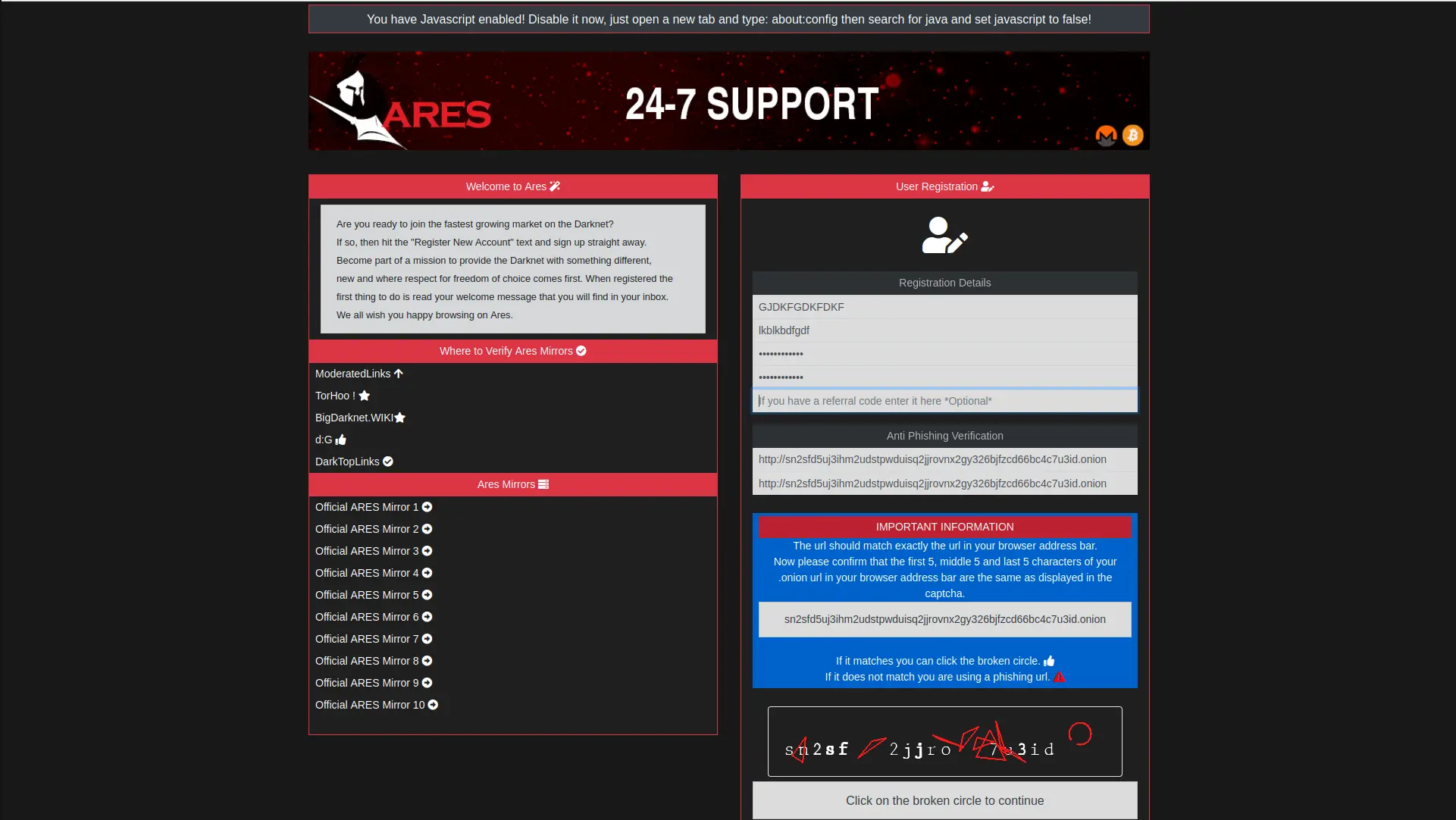

What security features did The platform offer?

The service implemented several security features during operation:

- Mandatory PGP Encryption: All communications required PGP encryption

- Two-Factor Authentication: PGP-based 2FA using digital signatures

- Login Phrase: Anti-phishing verification system

- Wallet-less System: Per-order escrow addresses instead of deposit wallets

- Monero Primary: XMR cryptocurrency for enhanced transaction privacy

- QR Code Payments: Error-reduction for address entry

However, these security features could not prevent exit scam because administrators retained centralized control over all escrow private keys despite wallet-less marketing claims.

Was The service really wallet-less?

Partially. The platform generated unique per-order escrow addresses rather than requiring users maintain marketplace wallet balances. This reduced centralized fund accumulation compared to traditional deposit wallets. However, The service administrators still controlled all escrow private keys, enabling unilateral access to funds. The wallet-less system reduced exit scam temptation but did not eliminate capability - Ares exit scammed anyway proving centralized control always enables theft regardless of wallet architecture.

Why couldn't The service security prevent exit scam?

Technical security features (PGP, Tor, Monero) protect against external threats but cannot prevent operator malice. The platform maintained centralized architecture where administrators controlled infrastructure, databases, and cryptocurrency private keys. Claimed "decentralization" features (Triple-Blind Escrow, DAO governance) were fake marketing with no blockchain evidence. Without true multisignature escrow or smart contract enforcement, exit scam remains structurally possible and eventually probable for centralized marketplaces.

Did The service use multisignature escrow?

No. Despite claims of "Triple-Blind Escrow" with multi-signature contracts, no blockchain evidence exists proving The platform implemented true 2-of-3 multisignature escrow. Exit scam execution demonstrates administrators had unilateral access to funds, impossible with properly implemented multisig requiring buyer-vendor-arbitrator cooperation. The service multisig claims were false marketing similar to Nexus fake DAO that exit scammed $15M in January 2025.

Cryptocurrency & Payments

What cryptocurrencies did The platform accept?

The service primarily accepted Monero (XMR) with Bitcoin (BTC) as secondary option. Monero was prioritized for enhanced transaction privacy through ring signatures, stealth addresses, and RingCT protocol hiding transaction amounts. This aligned with 2024-2025 darknet market trend where 50%+ of new marketplaces became Monero-only due to Bitcoin tracing risks from blockchain analysis firms like Chainalysis.

Is my The service Bitcoin transaction traceable?

Yes. Bitcoin transactions are permanently recorded on transparent public blockchain. Law enforcement and blockchain analysis firms can trace Bitcoin sent to The platform through exchange KYC data, controlled delivery package interceptions, clustering analysis linking addresses, and vendor cooperation deals. Users who sent Bitcoin to The service created permanent forensic evidence of darknet marketplace participation potentially usable for prosecution years later.

Does Monero protect me from The service exit scam?

No. Monero provides transaction privacy preventing blockchain tracing, but cannot protect against marketplace operator theft. The service accepted Monero specifically for privacy, yet still exit scammed stealing all escrowed funds regardless of cryptocurrency type. Monero hides transaction details from external observers but administrators controlling escrow wallets access funds directly without needing blockchain analysis.

Can law enforcement trace my The service transactions?

Depends on cryptocurrency used. Bitcoin transactions are fully traceable through blockchain analysis linking to exchange accounts with real identity KYC data. Monero transactions are cryptographically private but law enforcement may obtain information through exchange KYC if converting to/from fiat, marketplace database seizures exposing order metadata, controlled deliveries linking packages to addresses, vendor cooperation, and operational security mistakes revealing identity through non-cryptocurrency means.

Marketplace Comparisons

How does The service compare to other marketplaces?

The platform was Tier-3 regional player with 7,500 listings versus Tier-1 markets like Torzon (20,000 listings) and MGM Grand (16,000 listings). The service claimed unique wallet-less system but this feature became industry standard by 2024-2025. The marketplace never established trusted reputation with user complaints existing from early operation. Exit scam at 2-4 years consistent with marketplace lifespan patterns but smaller scale ($500K-$1M) than major exit scams like Abacus ($100M+, June 2025) or Nexus ($15M, January 2025).

Did The service have DAO governance like Nexus?

No. The platform claimed "DAO governance" and "Triple-Blind Escrow" but provided zero blockchain evidence proving decentralization. No governance token exists on any blockchain (Ethereum, BSC, Polygon searched), no DAO contracts deployed, no public multi-signature addresses verifiable. Similar to Nexus market fake DAO that exit scammed $15M, The service DAO claims were pure marketing deception. Exit scam execution proves centralized administrator control throughout operation.

Will The service return like White House Market?

No. White House Market closed peacefully in 2021 with advance notice, fund returns, and data destruction representing extremely rare ethical exit (less than 1% of marketplaces). The service exit scammed with theft, support blackout, and user complaints indicating malicious operator intent. Exit scam operators never return marketplace or refund stolen funds. Any site claiming to be "The service relaunch" is phishing scam.

Legal Risks

Can I be arrested for using The platform?

Potentially yes. Risks include package interception and controlled delivery (law enforcement allowing delivery then arresting recipient), database seizure if The service operators cooperate with law enforcement, vendor cooperation if arrested separately, cryptocurrency tracing linking to exchange KYC identity, and operational security mistakes revealing real identity. Prosecution risk varies by jurisdiction, purchase size, and substance type but all darknet marketplace participation carries legal risk.

What are penalties for darknet marketplace use?

Severe. Penalties vary by jurisdiction and activity but include: drug trafficking (10 years to life imprisonment in US), money laundering (up to 20 years), credit card fraud (up to 15 years), and asset forfeiture (all cryptocurrency proceeds seized). Vendor risks significantly higher than buyer risks. International cooperation (Europol, J-CODE task force) enables prosecution across borders as demonstrated by Archetyp marketplace seizure (June 2024) with administrator arrested in Barcelona.

Does Tor protect me from law enforcement?

Not completely. Tor provides strong network-level anonymity but cannot protect against marketplace database seizures exposing user data, controlled deliveries linking packages to addresses, vendor cooperation, operational security mistakes (using real name, home address, personal devices), cryptocurrency tracing, or malware deployed by law enforcement. Multiple Tor marketplace users arrested through combination of traditional investigation and operational security failures rather than Tor network compromise.

What should I do if law enforcement contacts me about The service?

Immediately exercise right to remain silent, do not answer questions without legal representation, refuse consent for searches unless warrant presented, contact criminal defense attorney specializing in cybercrime/drug cases, never admit marketplace participation or package ownership, and do not destroy evidence after law enforcement contact (potential obstruction charges). Early legal representation critical for minimizing charges and potential cooperation deals.

How do exit scams affect the darknet ecosystem?

Exit scams damage trust in the entire darknet economy. Each major exit scam (like this platform's $500K-$1M theft or Abacus's $100M+ scam) drives users toward more secure alternatives with multisignature escrow or decentralized architectures. Exit scams also increase law enforcement attention as victims sometimes report to authorities seeking recovery, creating operational security risks for entire darknet community. The cumulative effect pushes ecosystem evolution toward trustless systems where operators cannot unilaterally access funds.

Are there safer alternatives to centralized platforms?

Decentralized alternatives emerging but still experimental. OpenBazaar attempted peer-to-peer transactions removing centralized operators entirely but suffered from usability issues and vendor discovery problems. Blockchain-based escrow with smart contracts (Ethereum, BSC) provides trustless fund management but links transactions to permanent blockchain records. Multisignature escrow (2-of-3 between buyer-vendor-arbitrator) significantly reduces exit scam risk but requires all parties maintain keys securely. No perfect solution exists - all approaches trade security for convenience or privacy for trustlessness.

Security & Privacy Resources

Essential tools and information for darknet marketplace security:

- Electronic Frontier Foundation - Digital rights and privacy advocacy

- Privacy Guides - Privacy tools and best practices

- Tails - Live operating system for anonymity

- Whonix - Anonymous OS with Tor integration

- VeraCrypt - Disk encryption software

- KeePassXC - Secure password manager

- Wasabi Wallet - Privacy-focused Bitcoin wallet

- CoinGecko - Cryptocurrency prices and data

- Qubes OS - Security-focused operating system

- OnionShare - Anonymous file sharing tool

🕒 Page last updated: